“Pass the Turkey…and the Housing Forecast?”

It never fails—somewhere between the mashed potatoes and pumpkin pie, someone at the table brings up real estate. Maybe it’s your cousin debating whether to buy their first condo, or your uncle predicting a market crash. Real estate always finds its way into the holiday chatter, and this year is no different.

As 2024 winds down, all eyes are on the housing market forecasts for 2025. Industry experts from a variety of agencies and firms are predicting some encouraging, yet cautious, trends for the coming year. While challenges like inventory shortages and higher mortgage rates persist, the outlook points to a steady recovery—without fears of a housing crash.

But let’s be real: these so-called “housing experts” haven’t always nailed their predictions. In fact, many were way off last year when projecting huge price gains. A few were close, and one or two might’ve gotten it right, but it’s always wise to take these forecasts with a grain of salt. After all, the future of real estate is anything but predictable.

The Voices I Trust

When it comes to sorting through all the noise, I put the most weight on data-driven analysis from trusted sources. Logan Mohtashami at HousingWire is one of my go-to advisors. His charts, analysis, and no-nonsense approach to housing trends are invaluable because he sticks to the facts. Another expert I listen to is Ivy Zelman of Zelman & Associates. Her insights into housing market shifts are often spot-on—she’s right more than she’s wrong. When these two speak, I feel like I’m getting real advice for navigating the market, not just predictions.

Here’s what the experts are projecting (according to HousingWire) and what it means for buyers, sellers, and investors.

Home Prices Expected to Rise

On average, home prices are anticipated to increase by 2.6% in 2025. Here’s a breakdown of projections from leading firms:

- Goldman Sachs: +4.4%

- Wells Fargo: +4.3%

- HousingWire: +3.5%

- Pulsenomics Survey: +3.2%

- Fannie Mae & Morgan Stanley: +3%

- MBA: +2.9%

- Zelman & Associates, CoreLogic, Zillow: +2.3%

This growth reflects a market stabilizing after years of volatility, with regional variations likely influencing specific opportunities. For homeowners, the steady rise offers reassurance about equity gains, while buyers may feel more urgency to act before prices climb further.

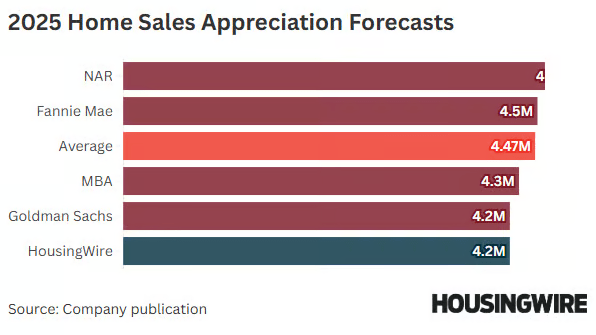

Home Sales on the Rise, but Below Norms

The 2025 forecast for home sales points to a slight recovery, with 4.47 million sales expected. Here’s what different organizations predict:

- Fannie Mae: 4.5 million

- MBA: 4.3 million

- Goldman Sachs & HousingWire: 4.2 million

- NAR: 4 million

Although this represents a 5% increase over 2024’s 4 million sales—the slowest pace since the 2008 financial crisis—home sales will remain below the 20-year average of 5.15 million.

What’s Driving the Market in 2025?

- Inventory Shortages

A lack of available homes has been the biggest hurdle in 2024, but there’s some good news: HousingWire predicts a 13% increase in active listings next year, with inventory reaching 720,000 by year-end. This could provide much-needed options for buyers while gradually easing price competition. - No Crash in Sight

Despite lingering concerns, experts agree there’s no housing crash looming. Instead, the market is on a path to steady, measured growth. Buyers may still face affordability challenges, but sellers can confidently plan without fear of major downturns.

What Does This Mean for You?

While forecasts aren’t guarantees, they provide valuable guidance to help shape your next steps:

- For Buyers: Inventory growth might present new opportunities, but acting sooner could help lock in better prices before further increases.

- For Sellers: Rising home prices mean it’s still a good time to sell, especially with inventory levels making competition less intense.

- For Investors: A stabilized market with moderate growth and no crash fears offers a relatively safe environment to expand your portfolio.

2025 is shaping up to be a year of cautious optimism for the housing market. Whether you’re buying your first home, upgrading, or investing, preparation is key. Let’s start the conversation about your goals and how to navigate the evolving market.

Ready to make your move in 2025? Let’s connect!

Leave a comment