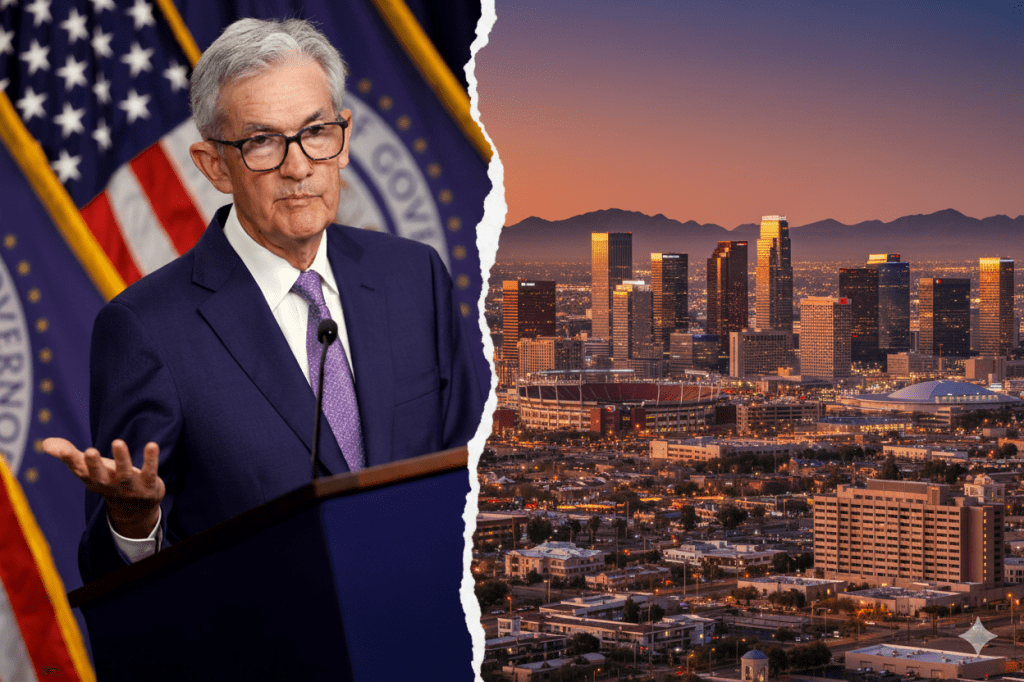

- The Fed’s Nervous. The Pros Are Shrugging. But If You’re Actually Watching Phoenix and Tucson… You Know What’s Coming.

Let’s not sugarcoat it: the Federal Reserve just sent up a flare. In their latest meeting minutes, they didn’t dance around the issue—they flat-out warned that the housing market slump could get worse. Worse than what we’ve already seen in Phoenix, Tucson, Flagstaff, and beyond? Apparently, yes.

Mortgage rates, which had hovered near 7%, briefly dipped to 6.215% after the Fed’s September rate cut—but that relief was short-lived. Rates rebounded within days, reminding everyone that the Fed doesn’t control long-term borrowing costs. Translation: buyers are tapped out, sellers are stuck, and the market’s bleeding momentum.

But here’s the twist: inventory in Phoenix and Tucson isn’t just rising—it’s exploding. We’re seeing more listings than we’ve seen in months, and yet homes are delisting faster than a bad Tinder match. Why? Because sellers are realizing that stale pricing and wishful thinking don’t cut it anymore. If your home’s been sitting for 30+ days, it’s not “waiting for the right buyer”—it’s overpriced, period.

And FHA delinquencies? Still elevated. That’s not just a stat—it’s a signal. When the most vulnerable homeowners start missing payments, it’s not just a blip. It’s a crack in the foundation.

Vice Chair Michelle Bowman didn’t mince words either. She said demand-side pressures—high rates, stagnant wages, brutal price tags—are now the dominant drag. And while some Fed members are pushing for more cuts, others are still clinging to inflation fears. So don’t expect a rescue mission anytime soon.

What does this mean for Arizona?

- Buyers: Brace yourself. Rates aren’t dropping fast enough, and inventory may look abundant, but affordability is still a beast. If you find something that works, move strategically—not emotionally.

- Sellers: Price like you mean it. There’s a reason homes are delisting so f***en fast—it’s not the market’s fault, it’s yours. Overpricing in this climate is like showing up to a potluck with a bag of ice and expecting applause.

- Investors: Please don’t call or text me asking if I know of off-market properties or if I want to represent you. I don’t. I work exclusively with one investor—someone who was introduced to me by another and actually hired me. That’s the bar. If you’re not bringing that level of commitment, keep it moving.

My Take:

Everyone’s modeling +1%, flat, or -1% like it’s some kind of safe zone. I don’t buy it. I see more of a drop coming—and it’s already underway if you’re paying attention. The real shift won’t happen until we have actual options: real single-family homes (3 beds, 2 baths, garage) for $300K or less in the Valley or slightly outside it. That’s when the market settles. Anything less than that? It’s a buying opportunity. Period.

Source: Federal Reserve warns housing market slump could get worse – Homes.com

Leave a comment