We’ve been talking about investing in manufactured housing for a while now — maybe Freddie Mac’s been secretly reading the blog and decided to jump in. Housing costs are through the roof, buyers are priced out left and right, and here comes Freddie saying, “Hey, maybe we should make more loans on manufactured homes.”

Welcome to the party, Freddie. You’re a little late, but better late than never. We’ve been pointing out for months that this is one of the most overlooked, underpriced, and opportunity-packed corners of the market. And now one of the biggest names in finance is confirming what we already know: manufactured housing is not just affordable — it’s investable.

According to their August 6th announcement, Freddie Mac is expanding financing options to increase the availability of affordable housing. The move includes support for more manufactured homes, aiming to give lenders and buyers more flexibility in today’s brutally expensive housing environment. Translation? They see what we see: people need more options, and investors need more angles.

“Manufactured homes are an important part of the solution to our nation’s housing affordability crisis,” said Sonu Mittal, Freddie Mac’s SVP of Single-Family Acquisitions.

This isn’t just a small tweak — it’s Freddie stepping in to broaden its reach in a market they’ve historically ignored. Traditionally, Freddie Mac loans have been geared toward first-time buyers or borrowers who fit neatly into the conventional mortgage box. Now, by expanding into manufactured housing, they’re opening doors for buyers and investors who’ve been shut out of the single-family home market thanks to rising rates and skyrocketing prices.

Freddie Mac Expands Manufactured Home Lending — What You Need to Know

🏡 Key Highlights:

- New Eligibility: As of August 6, 2025, lenders can now offer conventional CHOICEHome mortgages for single-section manufactured homes, not just multi-section ones.

- Affordability Boost: These homes typically cost around $200K including land, compared to over $500K for traditional site-built homes—making them a serious alternative for buyers priced out of the market.

- Construction Standards: Eligible homes must meet criteria like permanent foundations, energy-efficient features, pitched roofs, and attached garages, so they blend seamlessly into existing neighborhoods.

- Industry Support: Leaders like Clayton Homes praised the move for making energy-efficient, attainable housing more accessible—especially in urban infill areas.

- Mission Alignment: Freddie Mac emphasizes its commitment to expanding homeownership and addressing housing supply challenges through innovative financing.

This move is huge because it opens the door for more buyers to finally get into a home without the insane $500K+ price tag we keep seeing for traditional builds. Add in the fact that many manufactured homes are often well below the median, and suddenly what felt impossible might actually be doable.

Why This Matters in Phoenix

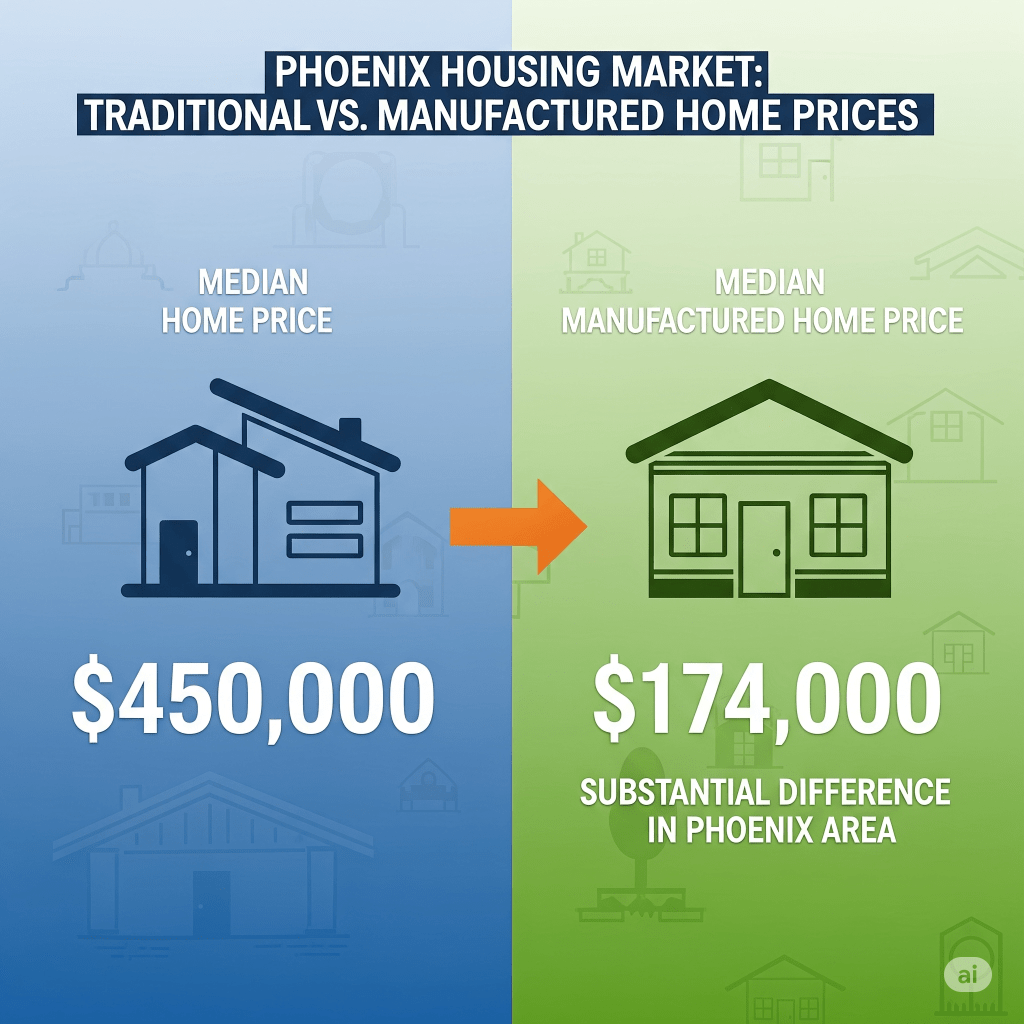

Phoenix is the poster child for why this move makes sense. Median home prices here have climbed to the point where even “starter homes” can feel like luxury listings. Manufactured housing — whether in communities, on leased land, or on privately owned lots — offers an entry point that’s thousands (sometimes hundreds of thousands) cheaper.

We’ve got pockets of manufactured housing in Phoenix, Mesa, Glendale, and especially in the East Valley, where communities range from 55+ resort-style living to low-maintenance starter homes for younger buyers. Investors have been quietly scooping them up because the rental returns can outperform traditional single-family properties — especially when purchased right.

The Investor Play

This isn’t just about affordable housing for buyers; it’s a massive investment opportunity. Lower purchase prices mean lower capital outlay, and with Freddie Mac financing now in the mix, the buyer pool just got bigger. That means more liquidity, potentially better resale opportunities, and another way to play the market without overpaying for a “standard” single-family home.

For months, we’ve been saying manufactured housing is one of the most neglected yet promising real estate plays in Arizona. Now that Freddie Mac’s giving it a stamp of approval, don’t be surprised if competition starts heating up.

Final Thought

We get it — this isn’t the luxury, shiny-object news that makes headlines. But that’s exactly the point. This market has been flying under the radar for years, and we’re bringing attention to it because we believe it’s a goldmine for out-of-the-box investors.

P.S. If you’ve been ignoring manufactured housing because it didn’t feel “big league” enough, remember — when Freddie Mac moves in, it’s not a fad. It’s a shift. And Phoenix is primed for it.

Source: Freddie Mac

The infographic shows median traditional homes at about $450K versus manufactured homes around $174K. But let’s be real — a lot of manufactured homes go for even less, sometimes dropping closer to or less than $100K. For buyers priced out of the traditional market, that’s a huge difference and a serious opportunity to get into homeownership without breaking the bank. – Juan C Pesqueira

Leave a comment