— What a difference a month makes

If you’re keeping tabs on the manufactured/mobile home market across Arizona, June brought some eye-popping changes — especially when it comes to median prices, which saw a noticeable dip from May. While that might make it harder to pin down exactly where the market is heading, these numbers still give a solid baseline for any buyer, seller, or investor trying to make sense of things right now.

Let’s break it down by city:

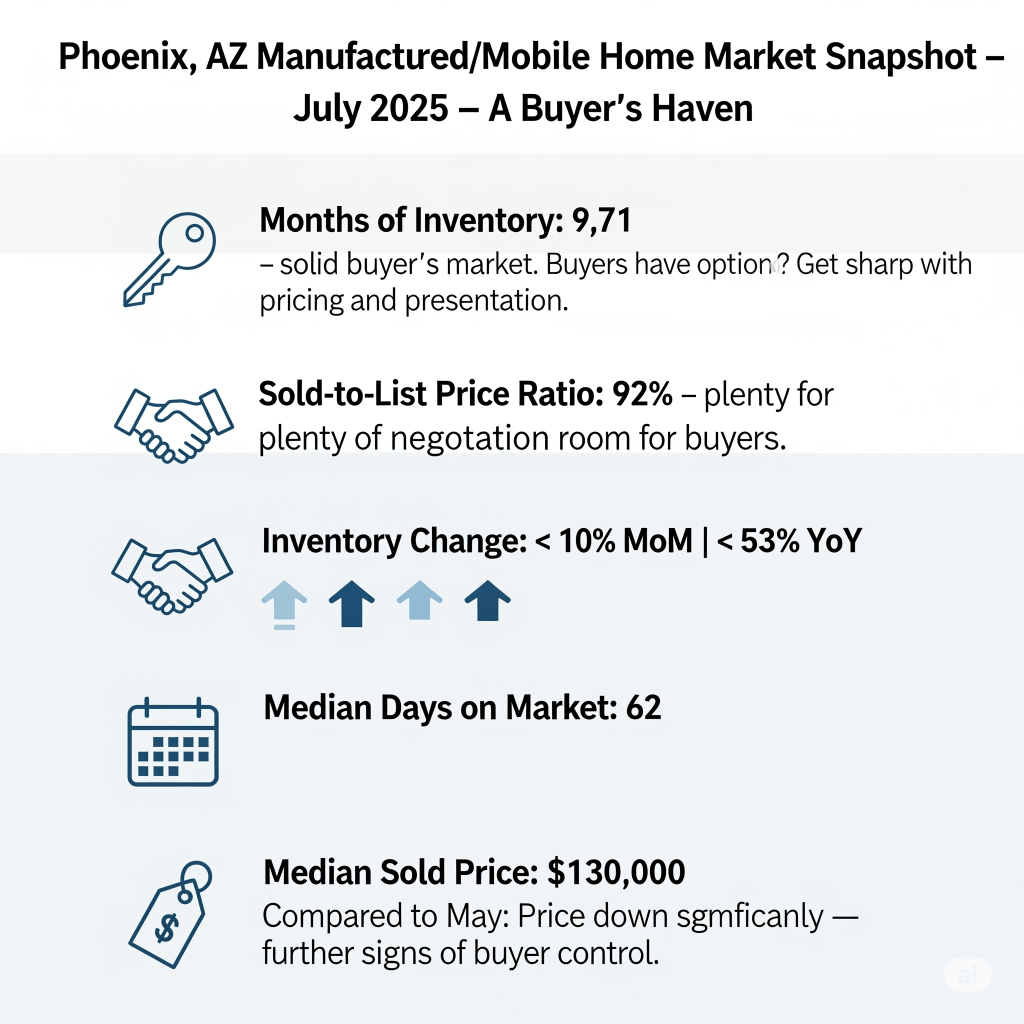

📍 Phoenix, AZ

- Months of Inventory: 9.71 → solid buyer’s market. Buyers have options. Sellers? Get sharp with pricing and presentation.

- Sold-to-List Price Ratio: 92% → plenty of negotiation room for buyers.

- Inventory Change: ⬆️ 10% MoM | ⬆️ 53% YoY

- Median Days on Market: 62

- Median Sold Price: $130,000

Compared to May: Price down significantly — further signs of buyer control.

📍 Mesa, AZ

- Months of Inventory: 8.38 → buyer’s market continues

- Sold-to-List Price Ratio: 93%

- Inventory Change: ⬇️ 3% MoM | ⬆️ 36% YoY

- Median Days on Market: 70

- Median Sold Price: $103,999

Compared to May: Pricing took a hit, making the market feel more negotiable than ever.

📍 Apache Junction, AZ

- Months of Inventory: 6.28 → balanced market, not leaning too hard either way

- Sold-to-List Price Ratio: 93%

- Inventory Change: ⬇️ 11% MoM | ⬆️ 23% YoY

- Median Days on Market: 68

- Median Sold Price: $96,000

Compared to May: Median price dipped, but pace remains steady.

📍 Glendale, AZ

- Months of Inventory: 8.63 → buyer’s market

- Sold-to-List Price Ratio: 95%

- Inventory Change: ⬇️ 0.2% MoM | ⬆️ 22% YoY

- Median Days on Market: 48

- Median Sold Price: $90,000

Compared to May: Market’s moving a bit faster, but prices softened.

📍 Tucson, AZ

- Months of Inventory: 7.51 → buyer-friendly

- Sold-to-List Price Ratio: 94%

- Inventory Change: No change MoM | ⬆️ 14% YoY

- Median Days on Market: 111

- Median Sold Price: $85,000

Compared to May: Median price has fallen, but overall market pace is steady.

Final Thoughts

The median sold prices across nearly every city dropped compared to May 2025 — making it a bit trickier to use those numbers as a hard market baseline. That said, this data still offers a strong starting point whether you’re buying, selling, or just keeping an eye on your investment.

🔍 Important Note: These prices and trends should be taken as a general market reference. Mobile and manufactured homes vary widely — some are land lease only, others are land-owned, and many sit in 55+ or retirement communities. That makes pricing less cookie-cutter than traditional real estate.

Still, if you’re active in this market, these trends are the pulse you want to keep an eye on.

And I get it—this isn’t the luxury, flashy, HGTV-style real estate news. But that’s exactly why it matters. The manufactured home market is often overlooked, and we’re putting a spotlight on it because we genuinely believe it’s one of the smartest plays for out-of-the-box investors. Lower buy-in, strong rental potential, and real demand? That’s a combo worth watching.

Let’s stop ignoring this niche and start taking it seriously.

Leave a comment