Yeah, yeah—I know. It’s July and we’re just now talking about the May 2025 NAR Commercial Market Insights. But just because it’s late doesn’t mean it’s not worth your time. Honestly, this report says a lot about where the market’s headed—and Phoenix is still very much in the mix.

This isn’t one of those “sky is falling” updates, but it’s not sunshine and lollipops either. Think of it as a pulse check: What’s moving? What’s stuck? Where’s the pressure building?

📊 See the full NAR report here

🛏 Multifamily: Still Standing, Still in Demand

Nationally, absorption is up 22%, rents are up a little (about 1%), and vacancies are hovering near 8%. It’s steady—not sexy, but steady.

But check this out—Phoenix is flexing.

➡️ In Q2 2025, we were in the Top 10 metros nationwide for 12-month absorption.

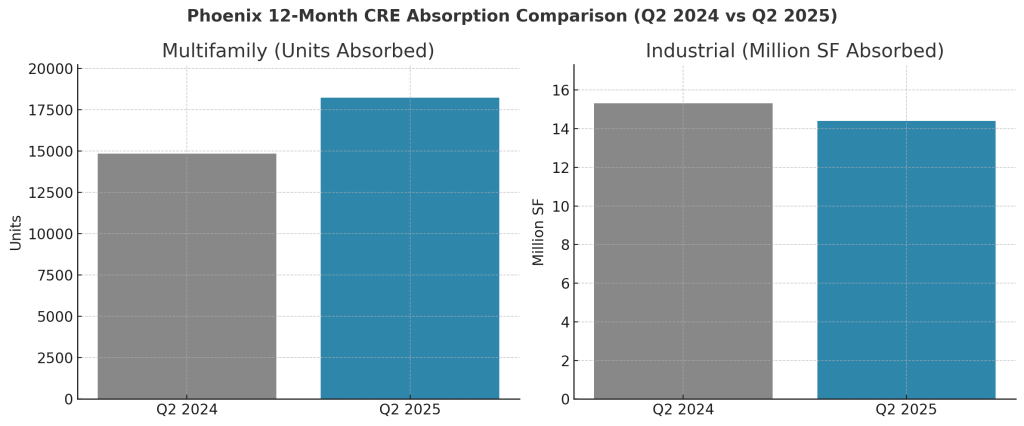

📈 18,243 units absorbed, up from 14,864 in Q2 2024.

People are still moving here. Renters are still showing up. But operating costs are chewing up profits. If you’re not tight on expenses or management, that shiny building will start bleeding cash.

🚛 Industrial: Still a Beast—But Slowing Down

Nationwide, industrial is cooling. Too much new space, not enough leasing velocity. Rent growth is softening and vacancy’s ticking up.

And yeah—Phoenix is feeling it too.

We’re still in the Top 10 nationally for 12-month absorption, but we’re off last year’s pace:

➡️ Q2 2025: 14.41M SF absorbed

⬇️ Down from 15.32M SF in Q2 2024

This market isn’t dead. West Valley is still moving, especially along logistics corridors. But spec builds without anchor tenants? That’s a risky play right now. Landlords are starting to offer concessions. Time to get creative if you want to fill that space.

🏢 Office: Same Story, Slight Shift

Office is still dragging nationally. 14% vacancy, flat rents, and more subleases than anyone wants to admit.

Phoenix is about the same. Class B suburban space is attracting life—especially when there’s parking and updated interiors. But downtown towers with 80s vibes? They’re collecting dust.

🛒 Retail: Quietly Resilient

Retail’s doing better than expected. Vacancy sits around 2.6%, with stable rent growth (~1.8%).

In Phoenix, retail in dense neighborhoods or near new housing is solid. Barbershops, tacos, and nail salons are paying the rent. Dead strip malls or outdated centers in traffic-less areas? Still dead weight—unless you’ve got a plan to reposition.

💸 CRE Debt: Quiet Pressure

The Fed kept rates flat in May, but commercial debt keeps climbing quietly. According to NAR, delinquencies ticked up again to 1.57%. It’s not a collapse—but it’s stress. And stress has a way of sneaking up on you.

Here in Phoenix, we’re starting to see it under the surface:

🔹 Loan extensions

🔹 Quiet workouts

🔹 Lenders offering “creative” refi solutions to keep borrowers afloat

If this sounds familiar, it should—we talked about it last month.

👉 Read: “CRE Debt Is Quietly Climbing—And That’s a Warning Sign” (June 19)

If you’ve been reading my blog, this isn’t news. It’s confirmation.

🧠 Final Take

Here’s where we stand:

✅ Phoenix is still active—especially in multifamily and industrial

⚠️ But absorption is slowing, costs are rising, and the dumb money is gone

💡 This market favors those with strategy, not just capital

Be patient, cautious, and conservative—but be ready to buy or sell depending on your position. And remember: we called this shift months ago.

➡️ Read: Phoenix Rising & Shifting – April 2025

So if you’ve been reading my blog…

Don’t say I didn’t warn you.

Leave a comment