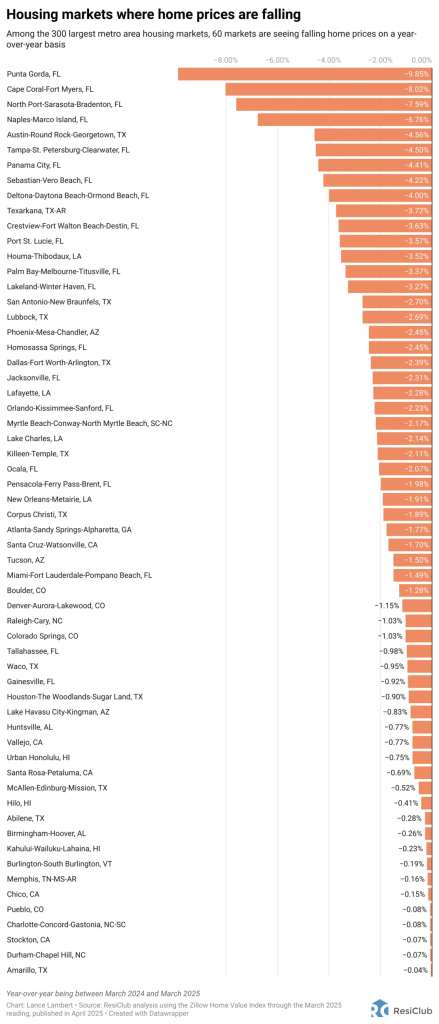

📉 In a surprising move, Zillow has turned bearish on the U.S. housing market. According to a recent analysis from ResiClub, the platform now forecasts a nationwide price decline of 1.7% between March 2025 and March 2026. That’s a major shift from their previously optimistic projections.

So, what’s behind this bearish turn?

🏘️ Rising Inventory = Cooling Market

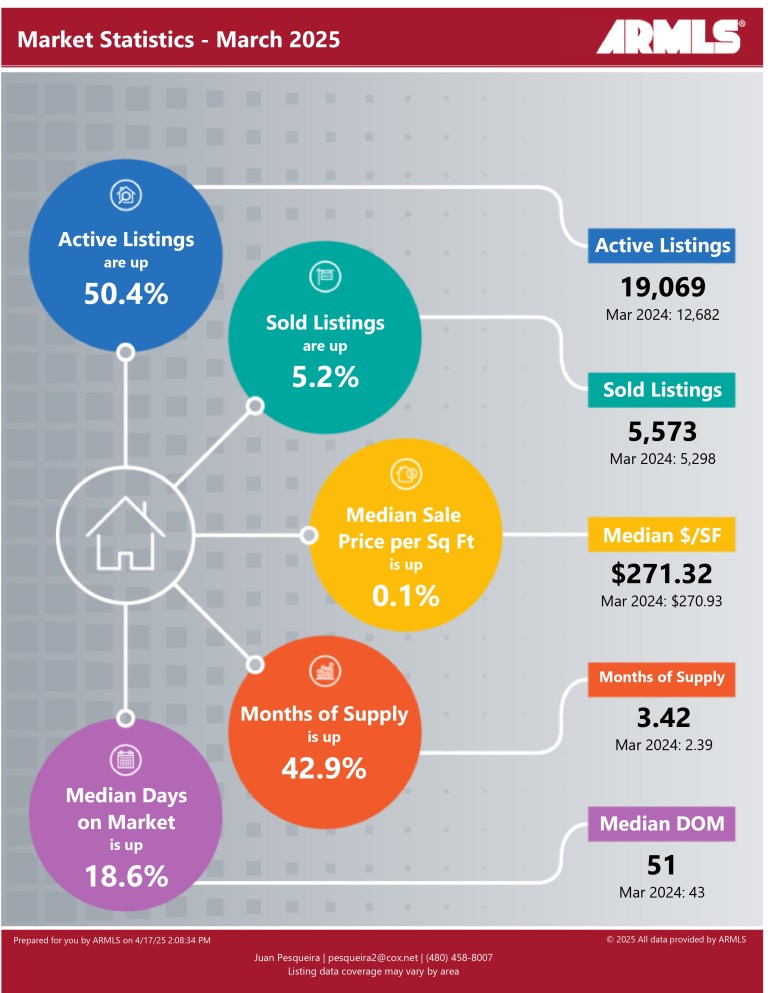

Across the U.S., more homes are hitting the market. Active listings are climbing, giving buyers more power and putting downward pressure on prices. Add in high mortgage rates and strained affordability, and Zillow’s logic becomes clearer.

But hold up — not every market is created equal. And Phoenix, Arizona? We’re still showing a little heat.

🔥 Phoenix Still in the Green — For Now

While Zillow’s broader outlook is grim, Phoenix bucks the trend with a projected 1.2% price growth over the next 12 months. Not exactly a boom, but compared to cities facing 5%–7% drops (we’re looking at you, Louisiana and parts of Texas), we’ll take the W.

Another stat worth noting: Maricopa County’s active inventory jumped to 19,069 homes at the end of March 2025, up from just 12,262 in March 2024. That’s a 55% year-over-year surge — a clear sign that buyers have more choices, sellers are feeling the competition, and prices may flatten if this trend continues.

💬 What the Reddit Crowd Is Saying

Over on Reddit’s r/REBubble, users are dissecting Zillow’s bearish pivot. Here are some standout takes:

💬 JeffreyCheffrey:

“Zillow is so bad at predicting future home price trends — they built an entire arm of the company to directly buy and flip homes, then shut it down because they failed to predict the very trends they now ‘forecast.’”

💬 PurpleOblivion:

“When the cheerleaders start turning bearish, you know things aren’t looking good. Zillow was bullish to a fault not long ago.”

💬 Reasonable_Cranberry:

“A drop of 1.7% nationally sounds small, but with inflation and carrying costs, that’s a real loss. And in some markets, it’ll be much worse.”

💬 Usual-Mulberry1776:

“Funny how the places with the worst predictions—like Louisiana and Texas oil towns—are the same ones that overheated fast and now can’t hold value.”

💬 zillowbadatmath (yes, real username!):

“They literally update their forecasts every month and keep lowering expectations. How is this considered reliable modeling?”

These insights highlight the community’s perspective on the shifting housing market dynamics.

🧐 What It Means for Phoenix Buyers & Sellers

- Buyers: More inventory = more negotiating power. But don’t expect a fire sale just yet in Phoenix. Price growth is cooling, not collapsing.

- Sellers: It’s time to be strategic. With more homes on the market, presentation, pricing, and marketing matter more than ever. Half-stepping it won’t cut it.

So, while Zillow is out here manifesting price gains like it’s 2021 all over again, the boots-on-the-ground data (shoutout to ResiClub Analytics) is already calling bluff. According to their April 2025 report, the Phoenix-Mesa-Chandler market is down -2.4%. Yep, while Zillow’s throwing confetti, home prices are quietly sneaking out the side door. It’s a classic case of “vibes vs. values” — and the values are blinking red.

Final Word: Phoenix Ain’t Crashing — But It’s Not Coasting Either

Zillow’s bearish turn is worth watching, but Phoenix remains a resilient market…

Leave a comment