October 2024: How is Phoenix Faring in the Commercial Real Estate Recovery?

As we step into Q4 2024, the Phoenix commercial real estate market (CRE) is a great case study for the broader national trends seen in the latest October 2024 insights from the National Association of Realtors. The Federal Reserve’s recent 50-basis-point interest rate cut was welcomed across the industry, promising potential relief for financing and borrowing costs. Many in Phoenix, including myself, are hopeful that the trend of easing rates will continue, potentially revitalizing CRE conditions even further.

Let’s take a closer look at what these updates mean for our local Phoenix market across the main CRE sectors—some of which are hitting new strides while others face distinct challenges.

Office Market: Phoenix’s Long Road to Recovery

Nationally, there’s cautious optimism in the office sector. For the first time in over two years, the U.S. is seeing positive net absorption of office space, meaning more offices were leased than vacated this quarter. This shift shows signs of improvement as some companies encourage a partial return to in-person work, even as remote setups remain common.

In Phoenix, where office vacancy rates have been a persistent concern, we’re witnessing similar incremental progress. While we may not yet be among the top metros seeing over a million square feet leased, this slow shift toward stability could attract new investors who are willing to take on risk for potential long-term rewards.

Multifamily Market: Phoenix Among the Leaders

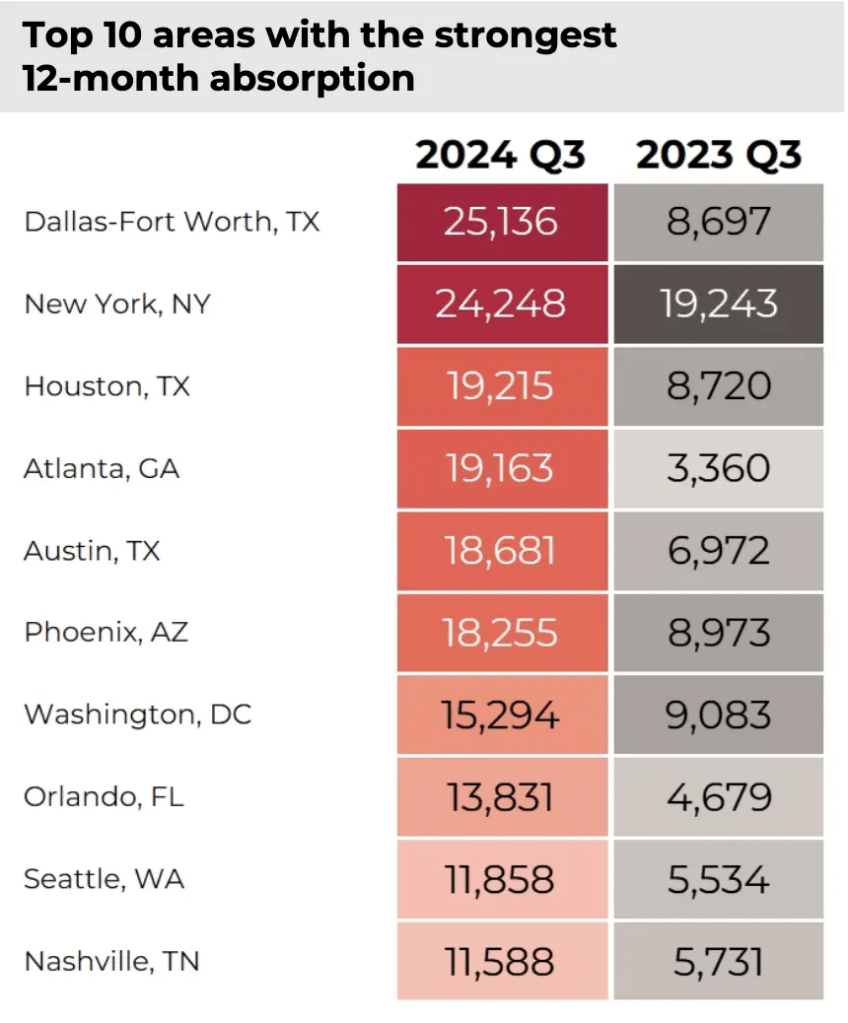

The multifamily sector has been an impressive performer, and Phoenix stands out. With our 12-month net absorption figures among the highest nationally (18,255 units absorbed this quarter compared to 8,973 last year), it’s clear that demand here is surging. Despite a slight dip in mortgage rates, rental demand remains high as new residents pour into the area. Vacancy rates have hovered near 8%, while rent growth has remained relatively steady around 1%.

Looking forward, demand might continue climbing, especially with the anticipated slowdown in new construction. This demand stability, coupled with Phoenix’s reputation as a top relocation destination, might give local multifamily investors continued confidence heading into 2025.

Retail Market: Tight and Tantalizing

The retail sector across the U.S. has been remarkably tight, and Phoenix is no exception. The vacancy rate has held under 5%, and new construction is slow, which keeps supply limited and competition high. In the past year, net deliveries of retail space have been below the decade average by about 40%, which is putting upward pressure on rents and keeping vacancy rates low. In Phoenix, retail investors and tenants alike might benefit from the recent rate cut as consumer spending picks up, keeping this tight market moving in a positive direction.

Industrial Market: A Mixed Bag with Potential

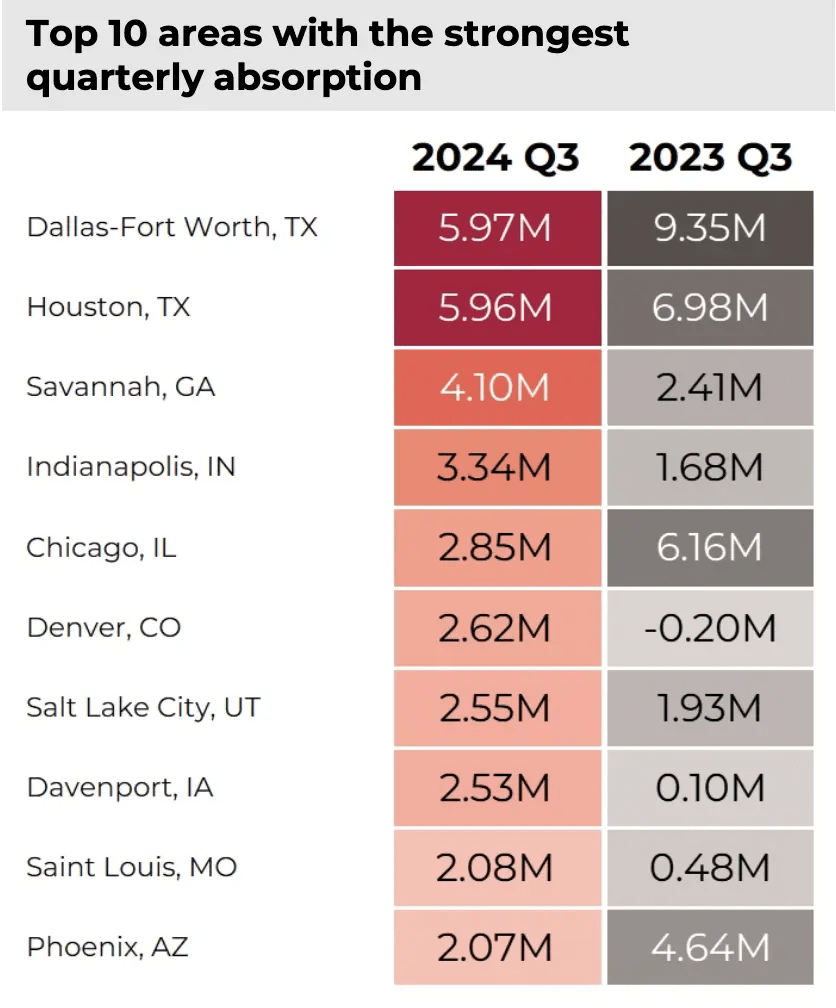

The industrial sector, though still strong, has started to lose some steam. Nationally, rent growth has slowed significantly, and the vacancy rate has edged up to 6.6% due to an increase in new supply. Phoenix, however, continues to be a hotspot, with a quarterly absorption of 2.07 million square feet—a strong indication that demand for industrial space remains high locally, even if the pace has slowed.

For Phoenix, the key will be balancing this new supply with demand. If inflation continues to drop and rate cuts make financing more accessible, we may see some of the shelved or paused projects resume. This could help bolster demand for industrial space, with Phoenix well-positioned to meet the needs of these projects.

Hospitality: Stable Yet Evolving

Finally, the hotel sector nationwide is stabilizing with occupancy around 63%, but we still lag behind pre-pandemic levels. Remote work continues to reshape travel and accommodation needs, a trend that impacts Phoenix’s hospitality market as well. While we may not see an immediate return to pre-COVID occupancy levels, the hotel sector here has shown resilience with average daily rates and revenue per available room exceeding previous highs, indicating Phoenix’s tourism appeal is still robust.

Phoenix CRE Outlook: Anticipation and Caution

Overall, the National Association of Realtors Monthly Update insights paint a complex but promising picture for Phoenix’s commercial real estate landscape. With Phoenix’s multifamily and industrial sectors highlighted as key players, the report brings a renewed focus on how these areas are shaping the local market. For investors, business owners, and residents, recent interest rate cuts could be a game-changer, easing some pressures and potentially revitalizing opportunities across the market.

The multifamily sector continues to shine as a top performer in Phoenix, driven by high demand and steady rent growth. Meanwhile, the industrial sector, though experiencing slower growth, still holds strong potential for those watching for renewed demand in production and distribution.

As the rest of 2024 unfolds, I’ll keep sharing Phoenix-specific insights to help you navigate these developments. While challenges remain, the outlook is cautiously optimistic—Phoenix is adapting and evolving with each market shift, and I’m excited to see where it leads us next.

Leave a comment