The latest National Association of Realtors Commercial Real Estate Market Insights for September 2024 highlights a few key national trends, but it’s worth seeing how Phoenix compares. Here’s a breakdown of both national and local data.

National Market Trends

By the end of summer 2024, the U.S. economy showed signs that the cooling effects of high interest rates might no longer be necessary. Inflation is nearing the 2% target, and the labor market is growing at a slower pace than before. With markets already anticipating a rate cut from the Federal Reserve, commercial real estate sectors are feeling the impact.

- Office Properties: The office sector is still dealing with record-high vacancy rates, despite improvements in demand. While some major markets have turned positive, new supply has kept vacancy high across the country.

- Multifamily Properties: Nationally, multifamily properties are seeing strong demand. Net absorption doubled from last year, but the vacancy rate remains near 8% due to new supply. Rent growth is holding steady, but we might see more increases next year.

- Retail Properties: Retail space is in short supply, with vacancy rates below 5%. Limited new construction and high demand are driving up prices, a trend expected to continue.

- Industrial Properties: The industrial sector has lost some steam, with vacancy rates climbing to 6.6%. Rent growth slowed from 8% to 3.2% as demand for industrial space cooled, largely due to an increase in supply.

- Hotel Properties: The hotel sector has stabilized, though occupancy rates are still about 3% below pre-pandemic levels. Despite this, average daily rates and revenue per room have surpassed pre-pandemic figures.

How Does Phoenix Compare?

Here’s where things get interesting: Phoenix is seeing some unique trends in the multifamily and industrial sectors.

Multifamily Properties in Phoenix: A Strong Performer

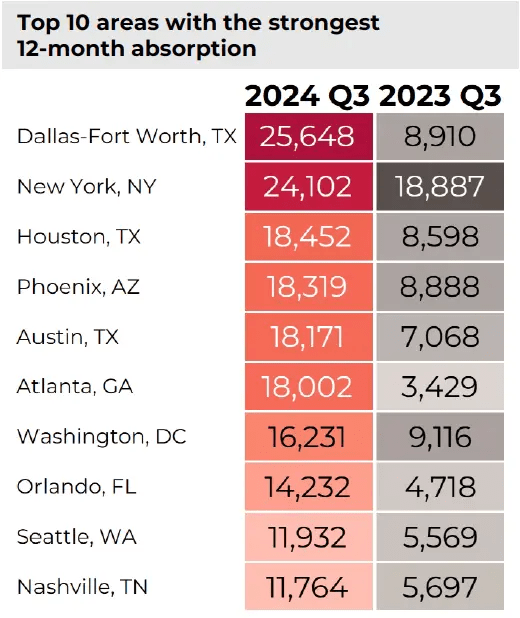

Phoenix continues to be a standout in the multifamily sector. In fact, Phoenix is among the top 10 areas for 12-month absorption, with a huge jump in demand this year. In Q3 2024, Phoenix absorbed 18,319 units compared to 8,888 units in Q3 2023. That’s more than double the previous year’s absorption! Even with national vacancy rates hovering around 8%, our local market is thriving due to housing affordability issues pushing more people to rent.

Industrial Properties in Phoenix: Slowing but Still Strong

Phoenix also made the top 10 for industrial property absorption, though it’s not quite as hot as it was. In Q3 2024, 13.79 million square feet of industrial space were absorbed, down from 19.38 million square feet in Q3 2023. This reflects the national trend of a cooling industrial market. However, with interest rates expected to ease, demand for goods could rise, which might spark renewed interest in industrial spaces.

For a deeper dive into the data, you can read the full NAR report here.

What’s Changed Since Last Month?

In just a month, Phoenix’s multifamily sector has gone from strength to strength, further cementing its place as a hot spot for investors. Industrial properties, on the other hand, are facing more challenges as demand cools and vacancies rise. Office spaces are still in a tough spot, with vacancy rates holding steady, but some national markets have seen an uptick in leasing activity—perhaps a sign that Phoenix’s office market could eventually stabilize.

If you’ve been following my blog or keeping up with my updates, you’ll know that I see huge opportunities in the Phoenix office sector for those willing to take on some risk. When it comes to industrial properties, it’s more about balanced risk tolerance, but success comes from being smart and selective. As for the multifamily sector, it’s always been strong here in the Phoenix and Scottsdale markets, but the key factor is the condition of the property—that’s where the costs can really add up.

Leave a comment