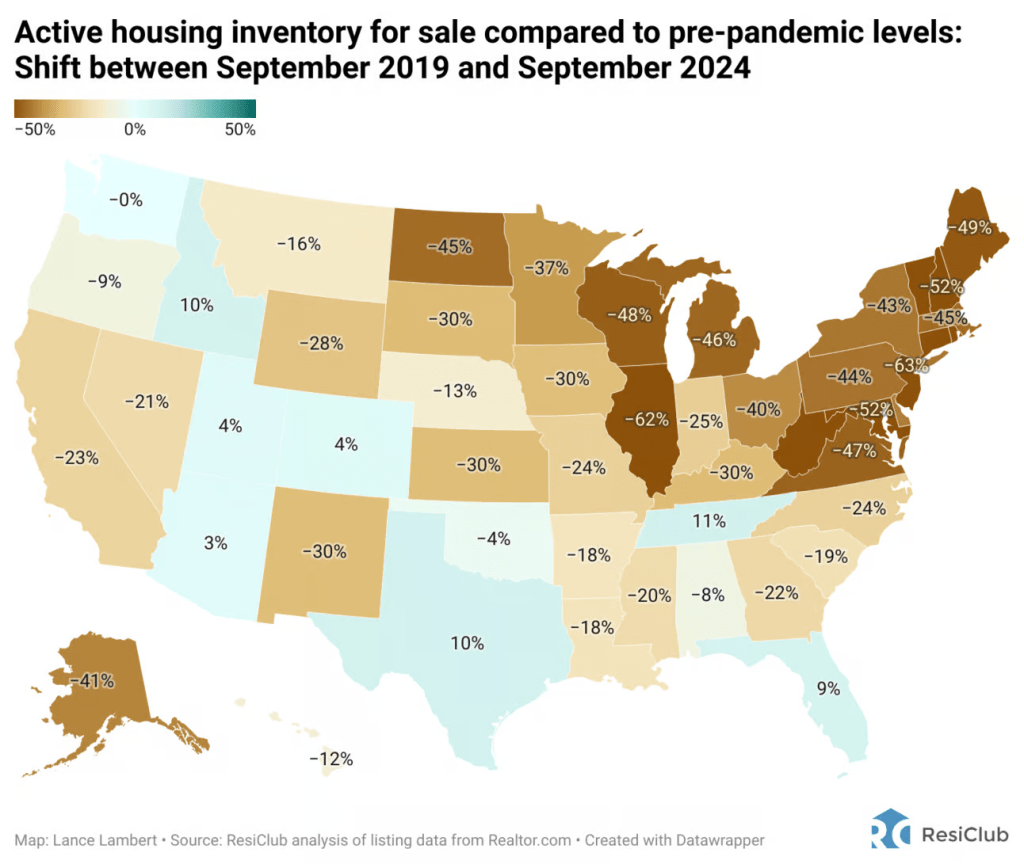

Arizona’s real estate market has reached a significant milestone—active inventory levels have returned to pre-pandemic numbers, placing it among seven states that have bounced back. ResiClub’s latest analysis, based on September data from Realtor.com, highlights how inventory levels are impacting price trends. With active listings increasing and homes taking longer to sell, the Arizona housing market may be entering a new phase, and it’s essential to understand what this means for both buyers and sellers.

Inventory and Price Trends: A Delicate Balance

Arizona’s return to pre-pandemic inventory levels reflects a cooling trend in the state’s housing market. Over the past two years, many markets across the state—particularly in hotspots like Phoenix, Scottsdale, and Tucson—experienced rapid price growth, driven by low supply and high demand during the Pandemic Housing Boom. However, as more homes become available, this momentum has started to soften, leading to slower price growth or even slight price declines in some areas.

While this is good news for Arizona, it’s important to note that the national housing market is still catching up. According to Realtor.com, active listings nationwide in September 2024 stood at 940,980—a significant rise from 702,430 in September 2023 but still well below pre-pandemic levels of 1,224,868 in September 2019. This means that although inventory has improved, we are still 23% below 2019 numbers on a national scale.

To put this into perspective, inventory numbers over the past few years have fluctuated as follows:

- September 2017: 1,308,607 📉

- September 2018: 1,301,922 📉

- September 2019: 1,224,868 📉

- September 2020: 749,395 📉 (overheating during the Pandemic Housing Boom)

- September 2021: 578,070 📉

- September 2022: 731,496 📈 (mortgage rate shock starts)

- September 2023: 702,430 📉

- September 2024: 940,980 📈

If we maintain the current pace of year-over-year growth (+239,594 homes), we could reach around 1,179,530 active listings by September 2025 and 1,418,080 by September 2026. While these numbers would bring us back to or above pre-pandemic levels, it underscores the fact that the national housing market still has some ground to cover before inventory is where it needs to be for healthy buyer-seller balance.

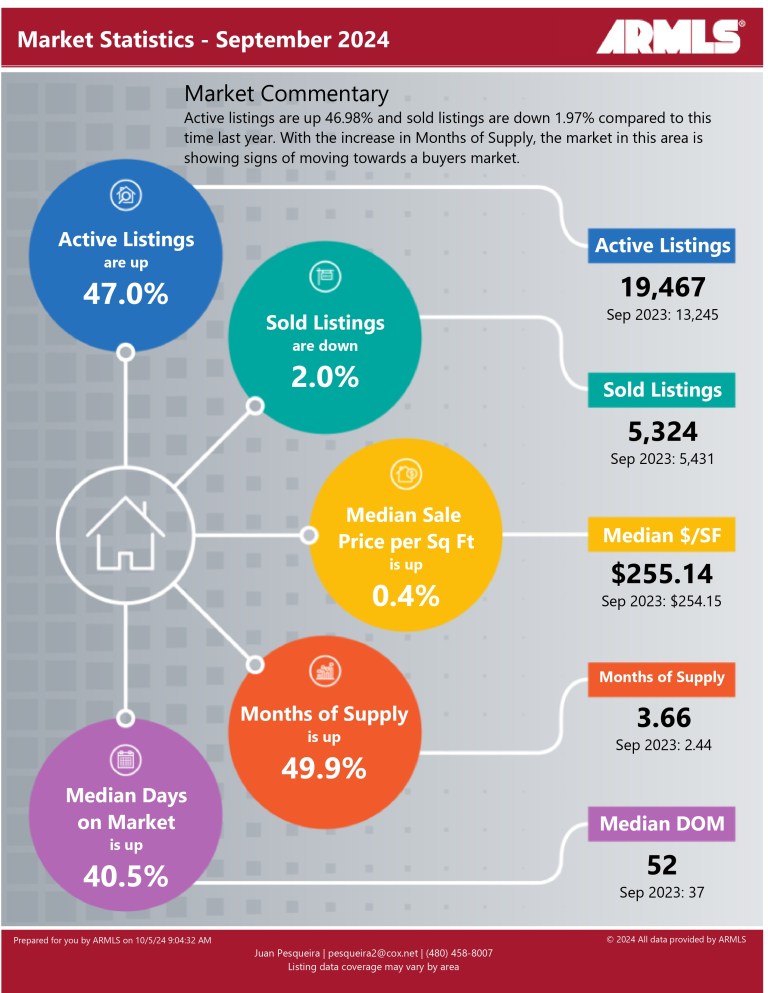

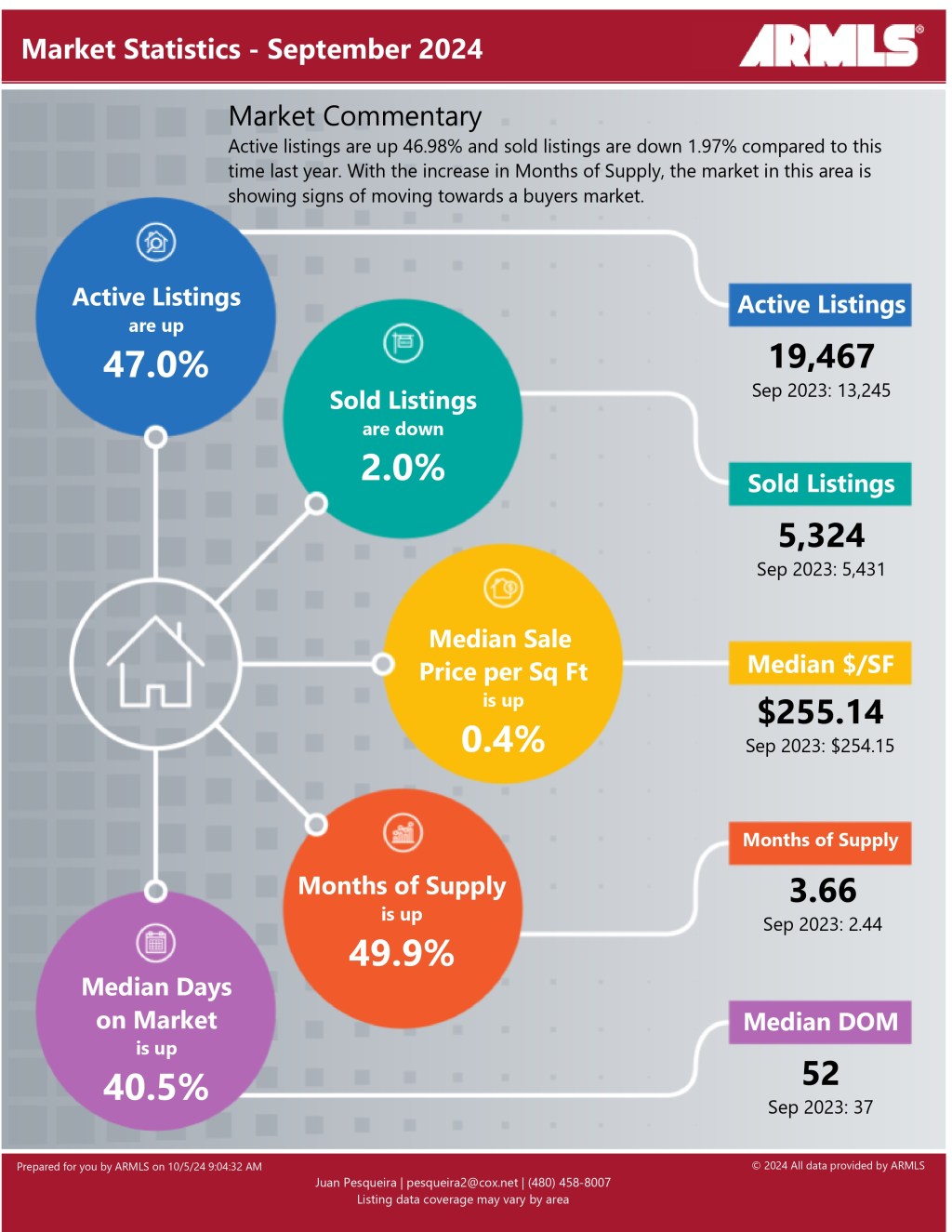

A Closer Look at Arizona’s September 2024 Housing Numbers

- Active Listings: 940,980 homes were on the market nationwide in September 2024, a 34% increase from September 2023.

- Pre-Pandemic Comparison: Arizona, along with states like Florida, Texas, and Colorado, has reached or surpassed pre-pandemic inventory levels.

- Phoenix Metro: Active inventory has grown, particularly in the condo and townhome sectors. This has been partly fueled by home builders offering aggressive incentives, such as mortgage buydowns, to clear unsold inventory.

- Tucson Market: A return to more balanced inventory levels has made the market less competitive, allowing for better negotiation opportunities for buyers.

As we examine Arizona’s housing market, it’s essential to look at the year-over-year changes in inventory levels. Here’s how the numbers stack up:

- September 2017: 26,464 📉

- September 2018: 24,289 📉

- September 2019: 21,632 📉

- September 2020: 11,582 📉 (overheating during the Pandemic Housing Boom)

- September 2021: 10,349 📉

- September 2022: 23,726 📈 (mortgage rate shock starts)

- September 2023: 15,383 📉

- September 2024: 22,362 📈

These figures illustrate the fluctuations in Arizona’s housing inventory over the past several years, highlighting a significant rebound in 2024. The sharp increase in inventory from September 2023 to September 2024 indicates a shift back toward pre-pandemic levels, suggesting a more balanced market for buyers and sellers alike.

Please note that the accompanying photo may show fewer homes for sale than the actual data suggests. This discrepancy occurs because the photo only includes homes listed on the Arizona Multiple Listing Service (MLS) and does not account for properties that are off the market, off the MLS, or being sold as For Sale by Owner (FSBO) on the open market. Therefore, while the visual representation offers a snapshot of the current market, it may not fully reflect the total available inventory.

What’s Next for Arizona’s Housing Market?

As Arizona continues to stabilize, the big question is whether inventory will keep rising and cause further price declines. According to ResiClub, active listings are expected to grow by over 239,000 homes nationwide by September 2025. If Arizona follows this trend, we could see further cooling, especially in areas where home prices are still out of reach for many buyers.

For Arizona home sellers, pricing your home competitively is more important than ever. With homes staying on the market longer, partnering with an experienced real estate agent who knows the latest market trends is key to getting it sold. And for buyers, this is a great window of opportunity—inventory is up, competition is down, and there are deals to be had – Juan C Pesqueira, Real Estate Agent.

Arizona’s return to pre-pandemic inventory levels signals a shift toward a more balanced housing market. However, on a national level, we’re not quite there yet. As active listings continue to rise, both buyers and sellers must navigate new conditions where strategic decisions will determine success.

Today’s average 30-year fixed mortgage rate sits at 6.26%, according to Mortgage News Daily. While rates dropped a few weeks ago following the Fed’s rate cuts, a strong jobs report last Friday has caused them to fluctuate back up slightly. So far this year, rates have ranged from a low of 6.11% to a high of 7.52%. The current spread between the 10-year Treasury yield and the 30-year fixed mortgage rate is 243 basis points, reflecting ongoing market adjustments.

All data and insights in this post are based on the thorough analysis provided by ResiClubAnalytics

Leave a comment