As we head into the final stretch of 2024, the commercial real estate market in Greater Phoenix continues to evolve. Some sectors are thriving, while others are facing challenges. In a recent discussion, NAIOP Arizona members, who are key players in the market, shared their insights on what’s happening in the region and what trends we should keep an eye on.

Medical Office: Phoenix Leads the Way

Margaret Lloyd from Plaza Companies highlighted that Phoenix is leading the country in the growth of medical office space. In 2023 alone, over 517,000 square feet were leased, far outpacing other major markets. While high construction costs are limiting new developments, there is strong demand for medical office space, especially in growing areas like Queen Creek and North Phoenix. This demand is fueled by population growth and a need for facilities such as rehabilitation centers, outpatient surgery centers, and micro hospitals.

Office Space: Flight to Quality

CJ Osbrink of Newmark pointed out a key trend in the office sector: a “flight to quality.” With more companies focusing on bringing employees back to the office, high-quality, amenity-rich spaces in popular areas like Tempe and Scottsdale are in demand. However, Class B and C office buildings are facing long-term vacancy, unless they are redeveloped or converted to other uses like industrial or multifamily.

The office sector is also seeing more adaptive reuse projects, where older office buildings are being converted into something new. But, as Osbrink and Lloyd noted, costs associated with conversions can be high, making it a challenge for many investors.

Multifamily: A Cooling Market, but Phoenix Remains a Key Player

Cindy Cooke from Colliers shared that while the multifamily market was booming from 2020 to 2022, it has cooled off in 2023 and 2024 due to rising interest rates and slowing new construction. However, Phoenix is still a major player. In fact, the metro area absorbed around 20,000 units this year, and the long-term outlook remains strong once the current pipeline clears.

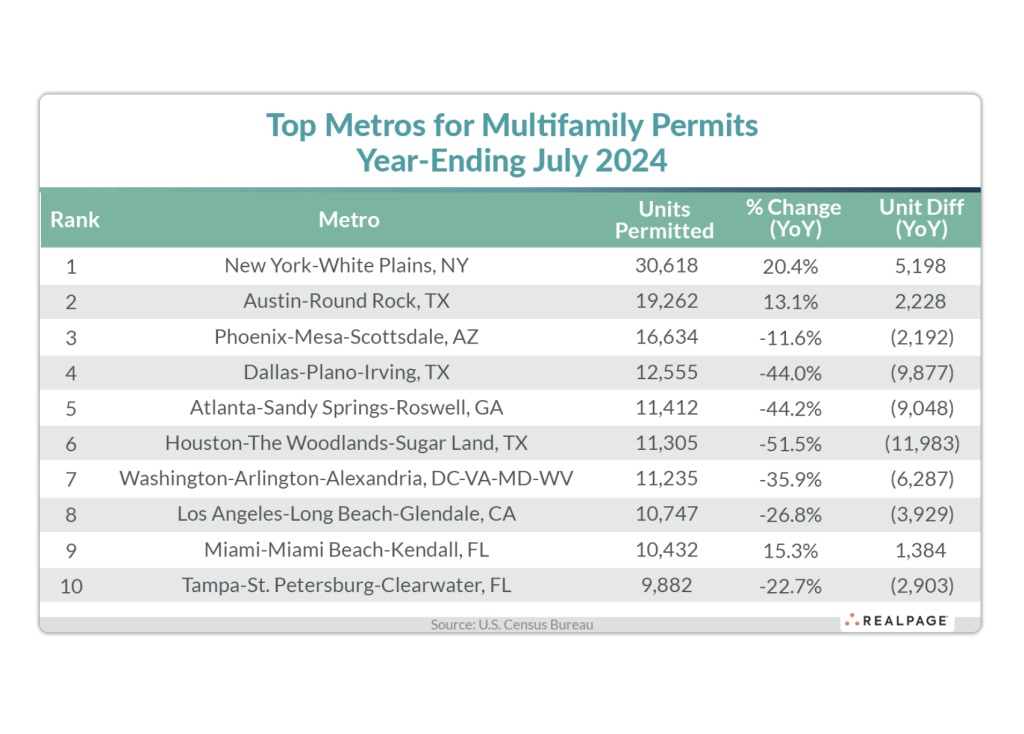

Looking at local statistics, Phoenix’s multifamily permit numbers have dipped compared to last year, but the city remains resilient. Of the top 10 U.S. markets that saw a decrease in multifamily permits, Phoenix had the smallest decline, with a year-over-year difference of 2,192 fewer units permitted. Despite the slowdown, Phoenix stayed in the top three for multifamily permits, with 16,634 units approved for the year ending July 2024. This figure is down about 5.3% from June and 12% from last year.

Phoenix is still holding its own when compared to other major markets. It remains close to Austin’s 19,262 units but trails behind New York, which tops the list with 30,618 units. However, Phoenix maintains a healthy lead over Dallas, which permitted 12,555 units. In terms of cities specifically, Phoenix ranks fourth, with 7,191 units permitted.

While the multifamily sector has cooled, the opportunities remain, especially as prices become more favorable for buyers looking to build wealth.

The permit information above was first obtained from AZBEX.

Retail: Evolution Post-Pandemic

Eric Termansen from Western Retail Advisors emphasized how quickly retail evolved during the pandemic. In a short period, the retail landscape shifted to focus more on food and less on traditional department stores. One interesting trend is the rise of drive-thru options, which have been a game-changer for food businesses like Starbucks, often doubling their sales. As for malls, they’re transforming into mixed-use spaces, with more entertainment and dining options taking over what used to be department store space.

Industrial: Power is the New Parking

Kelly Royle from JLL highlighted Phoenix’s growing industrial sector, though the vacancy rate has risen to about 11%. Interestingly, Royle noted a shift in tenant priorities, with power supply now becoming as important as parking. Many companies, especially manufacturers, are looking for buildings with sufficient power to run their operations, making this a key trend to watch.

What’s Next for Phoenix CRE?

Phoenix’s commercial real estate game is constantly evolving, and it’s a wild ride! Medical office space is thriving, office buildings are getting a makeover, and while the multifamily scene is cooling down a bit, there’s still serious potential for savvy investors. Retail is leveling up to meet new shopping habits, and industrial spaces are hotter than ever, especially with companies moving in from Cali.

Phoenix is gearing up to be a major player in the CRE world. If you’re an investor, developer, or business owner, now’s the time to get in the know and ride these trends!

Leave a comment