- National Market Wobble: Demand for distressed properties at auction is dipping due to rising “open market inventory” (regular homes for sale) in cities like Miami and Denver. This could lead to slower price growth.

- Bid-Ask Spread Widens: The gap between what buyers want to pay and what sellers ask for (foreclosure auctions: 3% to 6%, REO auctions: 8% to 11%) indicates growing uncertainty about market value.

- Arizona’s Bucking Trend: Unlike the nation, Arizona’s foreclosure auction market is booming with a 31% increase in activity and a 14% rise in average property prices. This suggests strong local demand for limited distressed inventory.

It seems like every day, someone on social media, in the news, on TV, or even in person is predicting a housing market crash, a flood of foreclosures, and urging everyone to wait before buying. But in today’s world, we have access to real data to help us understand the market. Based on Auction.com’s Auction Market Dispatch Key Market Insights Quarterly Report, the real estate auction market has been anything but predictable lately! We’re seeing some interesting new trends in Arizona, while the national market appears to be entering a more complex phase. Whether you’re a buyer, seller, or simply someone curious about real estate trends, let’s dive into what’s happening and why it matters!

National Trends: Demand for Distressed Properties is Dipping

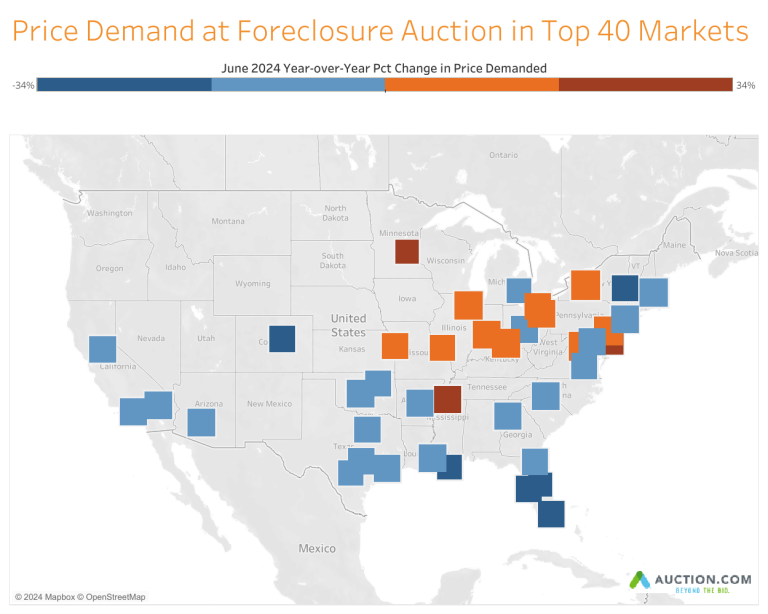

Let’s start with the big picture. In the second quarter of 2024, distressed property auctions (like those for foreclosures and bank-owned homes) started strong but showed signs of slowing down by June. Why? Fewer buyers were bidding, and those who did were willing to pay less. Even with a shrinking supply of distressed properties, demand took a hit.

So, what’s going on? It turns out that the number of regular homes for sale (known as “open market inventory”) is on the rise in many markets. Cities like Miami, New Orleans, Tampa Bay, and Denver have seen a flood of homes for sale—making auction buyers less aggressive. It’s like having too many options on a menu; it takes away the urgency to grab the first thing you see!

What This Means for Prices

If this trend continues, we could see a broader slowdown in real estate prices. Buyers of distressed properties—often investors who fix them up and flip them—are being more cautious. As Tony Tritt, a savvy developer in Northwest Georgia, put it, “I would expect a longer time horizon to get my renovated properties sold because they aren’t flying off the shelves like they used to.” If folks like Tony are hesitant, it could mean slower price growth (or even some price drops) in the near future.

Plus, there’s a growing gap between what buyers want to pay and what sellers are asking for—the “bid-ask spread.” In June, this gap widened, signaling uncertainty. Sellers aren’t budging on prices, but buyers are getting cold feet. When this happens, it usually means the market is pausing to catch its breath.

Understanding the Bid-Ask Spread: What’s the Deal?

Here’s a quick crash course on the “bid-ask spread.” Think of it like bargaining at a flea market: the “bid” is what buyers are willing to pay, and the “ask” is what sellers want to get. When the gap between these two numbers (the “spread”) gets bigger, it usually means there’s uncertainty or disagreement about the value of what’s being sold.

In the second quarter of 2024, this spread stayed pretty steady, but in June, it suddenly widened. Why? Buyers started to lower their offers, but sellers (like banks and mortgage companies) didn’t reduce their prices.

Here’s how it broke down:

- For foreclosure auctions, the spread jumped from 3% in April and May to 6% in June, the highest in 16 months.

- For bank-owned property (REO) auctions, the spread rose from 8% in April to 11% in June.

This widening gap tells us that buyers are becoming more cautious—they’re not as willing to pay the prices sellers are asking. Sellers, however, seem confident in their pricing. When these two sides don’t see eye to eye, it often signals that the market may be heading for a reset or slowdown.

To put it another way, imagine you’re looking to buy a foreclosed auction house listed for $300,000, but you think it’s overpriced and only offer $280,000. The $20,000 difference is the bid-ask spread. When this spread widens, it reflects a disagreement about the property’s value. Buyers are more cautious and less willing to meet sellers’ prices, which could be due to factors like economic uncertainty, rising interest rates, or concerns about the property’s condition.

Arizona’s Surprising Surge

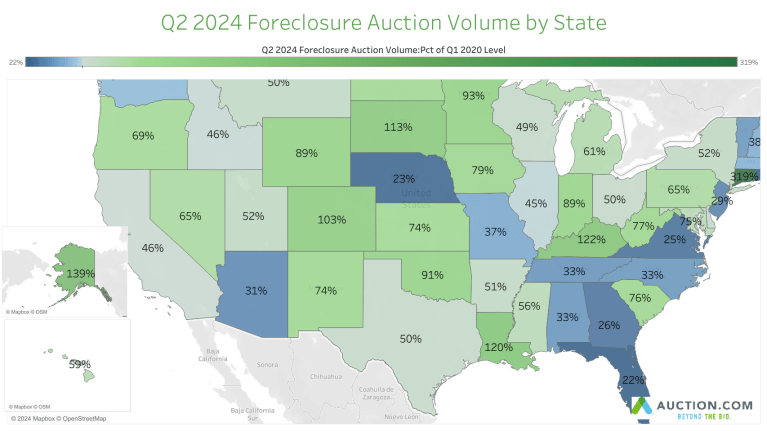

But wait—this blog is about Arizona. So, what’s happening in Arizona, Juan? Unlike the national market, Arizona’s foreclosure auction market has been heating 🔥 up! In the second quarter of 2024, auction activity in the state spiked by 31% compared to last year. Why the difference?

For one, Arizona is still seeing strong demand for distressed properties. Even as national trends point toward caution, Arizona’s market has been competitive. The average price for foreclosure properties in the state went up by 14% year-over-year, showing that buyers are still willing to pay a premium for limited inventory.

The Balancing Act: What’s Next?

So, what should we make of these mixed signals? While Arizona’s market shows resilience, it’s important to remember that national trends could eventually catch up. The increasing availability of homes on the market and the limited supply of distressed properties could start to influence buyer behavior and pricing in Arizona, just as it has in other states.

What’s the Bottom Line? Whether you’re buying, selling, or just watching the market, understanding these trends can help you make smarter decisions. If you’re in Arizona, take note: demand is still strong, but keeping an eye on the national picture will help you stay ahead of the curve. For everyone else, the recent slowdown in demand for distressed properties might just be a sign of things to come.

Don’t forget to follow this blog to stay tuned, stay informed, and see where this wild real estate ride takes us next!

Leave a comment