Based on the ARMLS Pending Price Index (PPI), Phoenix homebuyers can expect lower prices in July, with both the median and average sales price predicted to decrease.

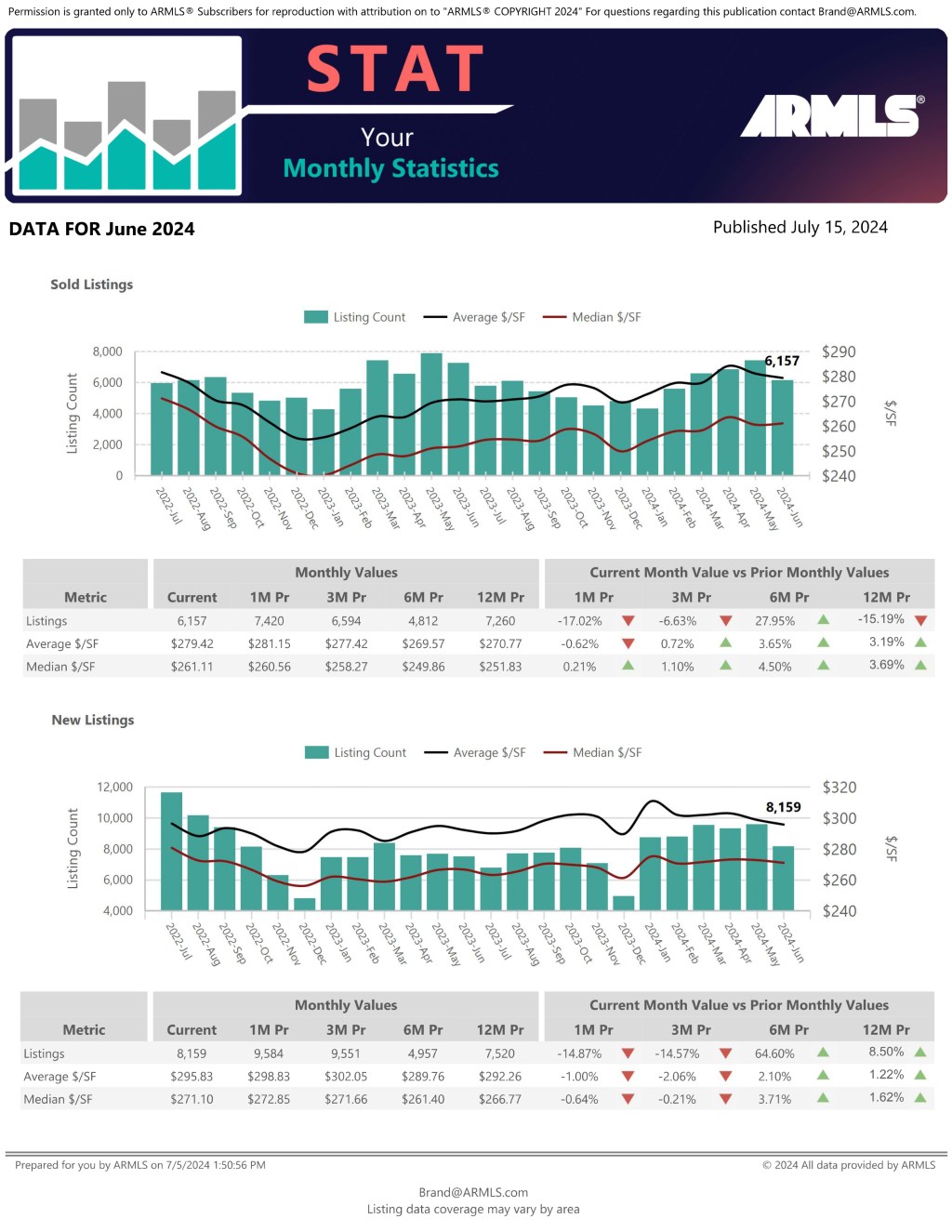

Looking Back at June

In June, the Arizona Regional Multiple Listing Service (ARMLS) predicted that homes would sell for a median price of $445,000, but the actual median price turned out to be a bit higher at $450,000.

Projections for July

For July, ARMLS is predicting a slight drop in the median sales price to around $435,000. Based on what I’ve seen (Tom Ruff’s statistical analysis for ARMLS), I think it might be closer to $440,000. Just last year, in June 2022, home prices hit a record high of $475,000. If the predictions are accurate, this July’s median price will be about 8.42% lower than that record high.

Homes Under Contract

When June started, there were 7,354 homes already under contract, meaning buyers and sellers had agreed on a deal but hadn’t closed yet. This is slightly less than the 7,581 homes under contract at the same time last year. This year, we had 277 fewer pending contracts compared to last year.

Home Sales in July

July has 22 business days this year, compared to 20 business days last year. In July 2023, there were 5,775 home sales. The busiest July in the last 20 years was in 2020, with 10,303 homes sold. Even though there are slightly fewer pending contracts this year (down by 2.99%), the extra business days mean we expect to see more sales this July. We think there will be around 6,200 home sales.

What This Means for You

The slight decrease in median home prices suggests the market is cooling off a bit. This can be good news for buyers looking for better deals, while sellers still benefit from a strong market. It’s all about timing and staying informed.

My Take:

As a real estate agent working in the Phoenix market, I see this news as a sign of the market stabilizing. The slight drop in median prices could create a more balanced environment where buyers have a better chance to negotiate and find good deals. For sellers, it’s important to remain competitive with pricing while showcasing the unique features of their properties to attract serious buyers.

The fact that we’re seeing a slight decrease after such a high peak last year isn’t cause for alarm. Instead, it’s a natural adjustment that can lead to a healthier market overall. For potential buyers, this could be a golden opportunity to enter the market before prices potentially rise again. For sellers, it’s a reminder to stay proactive and responsive to market conditions.

Wrapping Up

The ARMLS Pending Price Index gives us a peek into what to expect in the housing market. With July’s median sales price predicted to be between $435,000 and $440,000 and an increase in sales volume expected, the market is still going strong. Whether you’re buying, selling, or just curious, staying updated on these trends can help you make smart decisions.

Stay tuned to AriZona Real Estate Insider! for more updates and insights to help you navigate the real estate market.

A Shout Out to Tom Ruff

I’d like to give a special shout-out to Tom Ruff, who is retiring. Tom has written 189,727 words across 132 issues of STAT over 11 years. That’s the length of a solar cycle (the cycle that the Sun’s magnetic field goes through approximately every 11 years). This is his last issue of STAT.

Tom’s first issue was published in July 2013, looking back at June’s data, the calendar months we cover in this issue, ironically. Tom’s first words were, “As spring moves into summer and temperatures rise in Phoenix, it is not uncommon for sales volumes to slip, as was the case in June.” Tom understands seasonality more than anyone. Second only to working days of the month, a fundamental Tom taught many and echoed in STAT. A basic concept most of the national editorials about the market miss: Did sales really go up, or were there just more business days in the month?

Equal to Tom’s expertise is his wit. James Marcus, STAT publisher favorite issue of STAT (December 2019) is his plan to redevelop Sun City, called “City of the Future.” A pre-pandemic response to an article that was driving a lot of conversation in the Valley at the time. The article Tom was reacting to stated: “The same demographics that propelled Sun City’s rise now pose an existential challenge to this suburb as baby boomers age. More than a third of Sun City’s homes are expected to turn over by 2027 as seniors die, move in with their children or migrate to assisted living facilities, according to Zillow. Nearly two-thirds of the homes will turn over by 2037.” Tom went on to debunk the article with powerful data to the contrary, but also imagined what a millennial-only city would look like. A cat as mayor (which happened elsewhere), car-free zones, and pumpkin spiced everything. Some readers didn’t get the joke, but he was on to something. He used humor to tell the story, but there was always data behind his thinking – a rare combination for such a creative writer.

So, what comes next for STAT? ARMLS will continue to provide market stats and look for ways to provide insights into local market trends. Without further delay, here’s Tom’s last commentary.

Leave a comment