Hey there storage enthusiasts!

Hope you’re all having a fantastic week! We’re excited to share some insights from Rent StorageCafe latest blog post that might pique your interest, especially if you’re keeping an eye on self storage trends.

In a recent report by Rent StorageCafe, Phoenix made a significant mark, clinching the 9th spot among the top underserved markets for self storage development. The study delved into the dynamics of self storage demand and supply across the 150 largest U.S. metro areas, pinpointing locations ripe for expansion and those already meeting market needs.

So, what makes Phoenix stand out in the self storage landscape? Let’s break it down.

The Phoenix-Mesa-Chandler area isn’t just about sweltering summers and scenic desert landscapes; it’s also a hotspot for self storage growth potential. Boasting positive rent performance and fueled by factors like burgeoning household formation and a robust remote work scene, Phoenix is a market brimming with opportunities.

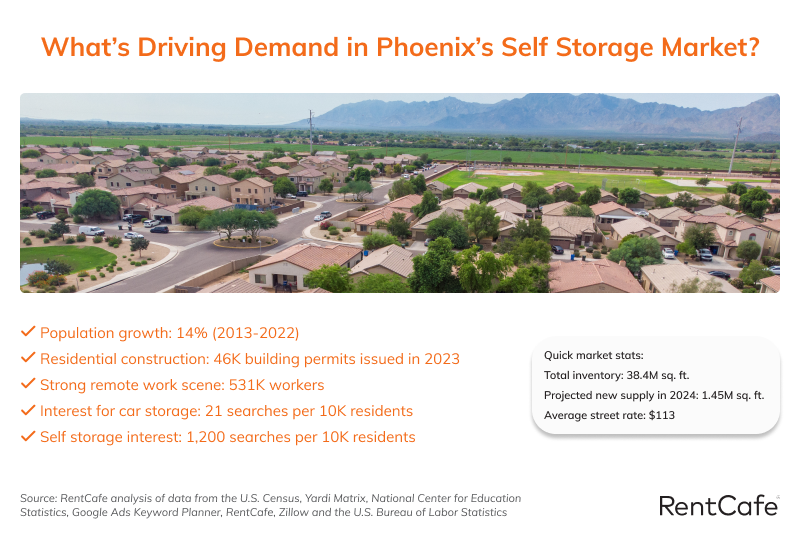

The metro area’s allure as one of the top relocation destinations is bolstered by its vibrant job market and relatively affordable living costs compared to other major U.S. cities. Over the past decade, Phoenix has experienced a remarkable 14% surge in population and a whopping 22% increase in households, setting the stage for further expansion in the self storage sector.

With 8.4 square feet of storage space per capita, Phoenix is poised for more growth. The demand for self storage is palpable, evident in the approximately 1,200 monthly Google searches for storage options per 10,000 residents, alongside consistent inquiries for vehicle storage solutions. Clearly, Phoenix is a market to keep a keen eye on.

To gain deeper insights into current market trends and growth prospects, Rent StorageCafe caught up with Doug Ressler, business intelligence manager at their sister division, Yardi Matrix. Here’s what he had to say:

“Amid economic headwinds, the self storage industry exhibits a stance of cautious optimism. Despite a noticeable reduction in new constructions compared to the 2019 peak, when 65 million square feet of storage space was added, the sector is gearing up to introduce an estimated 54 million square feet by the end of this year. This scale-back in development is a response to several pressing challenges currently facing the industry, including inflation and political unrest. These factors have contributed to a decline in occupancy rates by 2-3% and a 4-5% decrease in income from storage operations year-over-year.

However, the industry finds a silver lining as the economy is actually doing better than expected, giving the self storage sector solid ground to stand on for future growth. In fact, despite the downturn in some operational metrics, rental rates remain 8.7% higher than prepandemic levels.”

Exciting stuff, right? If you’re curious to explore self storage development prospects in the top 150 metro areas, dive into the detailed report here: https://www.rentcafe.com/blog/self-storage/top-underserved-markets-for-self-storage-development/.

As the self storage industry navigates through challenges and embraces opportunities, Phoenix shines as a beacon of potential. Keep your sights locked on this dynamic market—it’s poised for even greater things in the realm of self storage.

9. Phoenix-Mesa-Chandler, AZ

Self storage per capita: 8.4 sq. ft.

2024 completions as % of existing inventory: 3.8%

Online self storage searches per 10,000 residents: 1,193

Population change 2013 – 2022: 14.0%

Household size: 2.6

Household formation change 2013 – 2022: 21.7%

Housing density per square mile: 142

Residential building permits 2023: 45,637

Average apartment size: 847 sq. ft.

% of apartments with storage: 63.1%

Rental competitivity index: 8.1

Homes for sale inventory changes, 2018 – 2013: -33%

Mobile homes inventory: 113,017

Online searches for student storage per 10,000 residents: 0.4

No. of students: 488,465

Business storage searches per 10,000 residents: 1.1

No. of households with more than one car: 1,159,921

No. of vehicle storage units: 6,040

Car storage searches per 10,000 residents: 21.0

No. of remote workers: 531,371

Decluttering searches per 10,000 residents: 1.4

Income growth 2013 – 2022: 60%

Household income: $82,884

Unemployment rate: 3.6 %

Y-o-Y employment change: 2.3%

Until next time, happy storing and a special Thanks to Bianca Barsan Communications Specialist | RentCafe Self Storage for sending me the report.

Leave a comment